Voted Best Company for Travel Insurance 7 years in a row by the British Travel Awards

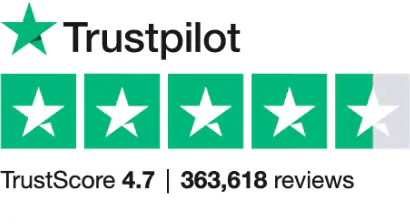

Most reviewed travel insurance provider with 312,456 reviews

Defaqto 5 star rated Travel Insurance Comprehensive and Signature cover